Canceling an insurance policy can seem daunting, but it doesn’t have to be. Whether you’re switching providers, selling your vehicle, or simply reassessing your insurance needs, canceling your Root Insurance policy can be a straightforward process with the right guidance.

Understanding Root Insurance:

Before diving into the cancellation process, it’s essential to understand what Root Insurance offers. Root is known for its usage-based insurance model, which determines premiums based on driving behavior. While this can lead to savings for safe drivers, it’s crucial to assess whether Root remains the best option for your circumstances.

Reasons for Cancelling:

Several reasons might prompt you to cancel your Root Insurance policy.

Better Rates Elsewhere: You’ve found a better deal with another insurer.

Changed Circumstances: Your driving habits, vehicle ownership, or personal situation have changed.

Dissatisfaction: You’re unhappy with Root’s services, coverage, or customer support.

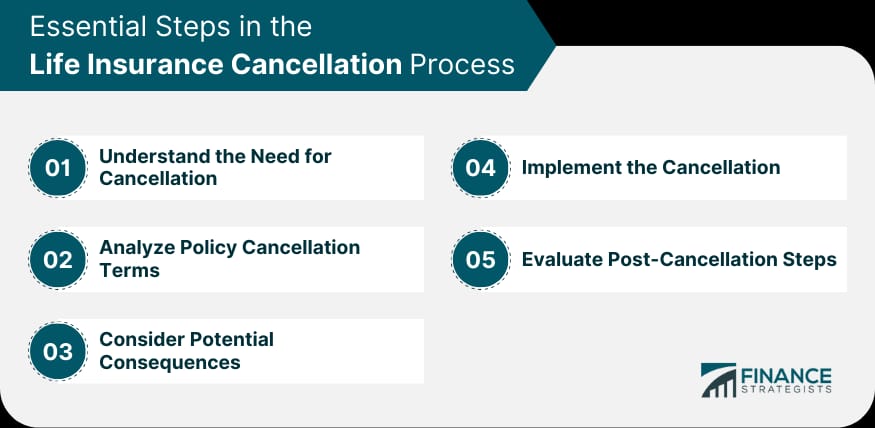

Review Your Policy: Before initiating the cancellation process, review your Root Insurance policy. Take note of any cancellation fees, refund policies, or potential repercussions for early termination. Understanding these details can help you navigate the process smoothly.

Contact Root Insurance:

Once you’ve decided to cancel, reach out to Root Insurance. You can typically cancel your policy through various channels:

Online Portal:

Many insurers, including Root, offer online platforms where policyholders can manage their accounts and initiate cancellations.

Customer Service:

If you prefer speaking with a representative, contact Root’s customer service team via phone.

Mobile App:

Root’s mobile app may also provide options for canceling your policy.

Provide Necessary Information:

When canceling your Root Insurance policy, be prepared to provide relevant information, including:

Policy Details:

Have your policy number and relevant account information on hand.

Reason for Cancellation:

While not always required, explaining your reason for cancellation can help Root improve its services and provide better assistance.

Cancellation Fees and Refunds:

Depending on your policy terms and state regulations, you may incur cancellation fees. These fees can vary, so it’s essential to review your policy documents or inquire with Root’s representatives. Additionally, inquire about any potential refunds for unused portions of your premium.

Consider Alternatives:

Before finalizing your cancellation, consider alternative options:

Switching Insurers

Research other insurance providers to find the best coverage and rates for your needs.

Pause Coverage

If you’re temporarily suspending vehicle usage, inquire about options for pausing your coverage instead of outright cancellation.

Policy Adjustments

If your circumstances have changed, such as selling a vehicle or moving, explore options for adjusting your policy rather than canceling it entirely.

Document Everything:

Throughout the cancellation process, keep detailed records of all communications with Root Insurance. Note dates, times, and the names of any representatives you speak with. This documentation can be valuable in case of disputes or discrepancies.

Confirm Cancellation:

After initiating the cancellation process, confirm with Root that your policy has been successfully canceled. Request written confirmation or an email verifying the cancellation details for your records.

Next Steps After Cancellation:

Once your Root Insurance policy is canceled, there are a few additional steps to consider:

Replace Coverage

If you’ve canceled your policy without securing alternative coverage, prioritize finding a new insurance provider to avoid gaps in coverage.

Refunds and Payments: If applicable, expect any refunds for unused premiums and settle any outstanding payments with Root Insurance.

Update Records

Ensure that any relevant parties, such as vehicle lienholders or state departments of motor vehicles, are notified of the insurance policy change.

Final Words

Canceling your Root Insurance policy doesn’t have to be complicated. By understanding the process, communicating effectively with Root’s representatives, and considering alternative options, you can navigate the cancellation process smoothly and transition to the next phase of your insurance journey with confidence